The IT market is an ever-changing environment, where opportunities for development are limitless. The CEE region where all NATEK Business Units are located (in Poland, Czechia, Bulgaria and Slovakia) shows immense potential for further lucrative investments in IT projects and more importantly - people. Moreover, consistently for the past 20 years of NATEK in the business, we find that our perspective on technological innovations is an invaluable asset to many of our Customers and Business Partners. That is why we decided to compile our current knowledge of the region into a powerful NATEK CEE IT Market Report.

Why should you invest in the development of IT projects in the CEE Region?

NATEK is a fast-growing IT outsourcing company, with offices in 4 countries and 7 cities located in CEE, where we employ over 800 Specialists from areas such as: Software Development, Cloud, SAP, Modern Workplace, Infrastructure, Service Desk, and many more. Almost twenty years ago, we discovered the indisputable potential of this region and decided to build there our business, striving for fast expansion and influencing the local IT market. Our report shows that we made the right choice seeing that the IT sector in Poland, Czechia, Bulgaria and Slovakia was worth EUR 23.6 billion in 2023, with Poland as a leader in the region obtaining an IT sector share of 8% in the country’s GDP and a growth rate of 8.6%. Furthermore, with over 130 thousand ICT students and 19 thousand graduates annually coming from Poland, Czechia, Bulgaria and Slovakia, the CEE region has become a key hub for the global tech industry.

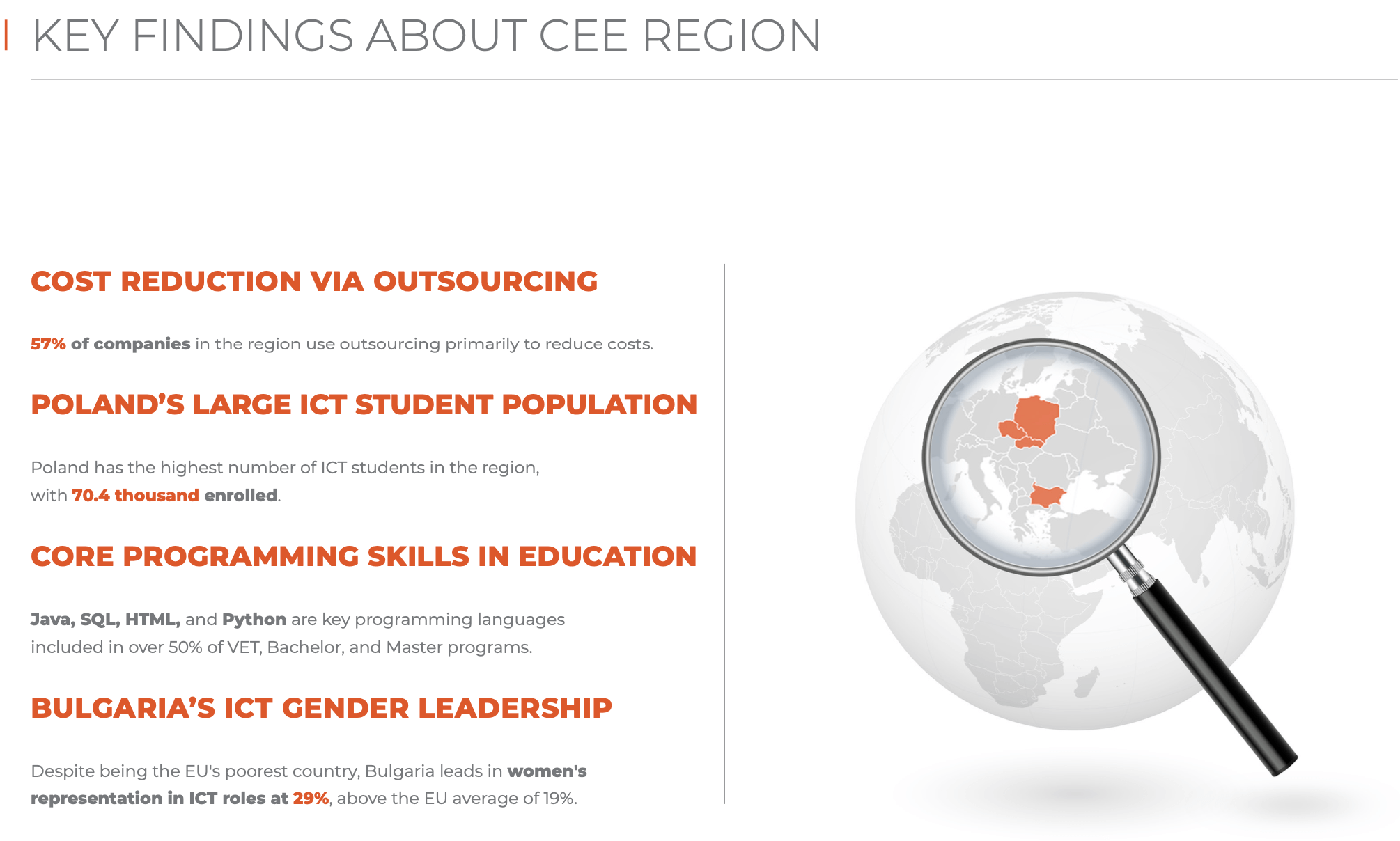

It’s also important to note that with software development and cloud computing at the forefront of the most relevant and dynamically developing IT services in the CEE region, the public cloud services market in Central and Eastern Europe is foreseen to grow by 17.8% year-on-year between 2022 and 2029 and is expected to reach 29 billion EUR in 2029. We can also see that the trends dictated by the IT industry heavily influence the world of academia, establishing Java, SQL, HTML and Python as the key programming languages included in over 50% of VET, Bachelor, and Master programs, and essential for most of the currently developed tech projects on the market.

Poland

Poland is the leader in the CEE region when it comes to the ICT sector. It employs over 0.5 million people and generates over EUR 9 billion from exports. An average annual increase in turnover for the Polish ICT sector is over 8.6%, the highest development rate in Europe, and the sector was worth EUR 22.6 billion in 2023 with a growth rate of 11.4%. In 2023 Poland's strategic location, robust economy, skilled workforce, and growing market earned it a title of one of the most attractive countries to invest in, as voted by almost 50% of foreign investors. The country offers a wide selection of midsize and large outsourcing vendors catering to diverse industries. Poland's commitment to digital transformation and its well-established outsourcing infrastructure further enhances its appeal to businesses seeking to optimize costs and drive innovation.

Czechia

Czechia offers a favorable cost structure and an educated workforce, which are crucial for businesses looking to optimize costs and enhance their technological capabilities. The country’s economic stability, high level of industrialization, and advanced digitalization make it an attractive destination for investment. IT industry is a dynamic sector of their economy, with a value amounting to EUR 3.6 billion in 2023 (accounted for approximately 11.4% of the Czechia’s GDP that year), which is predicted to increase by EUR 2.16 billion by 2028. One of Czechia’s standout IT sectors is the software market, set to achieve EUR 1.6 billion in 2024, with enterprise software accounting for EUR 0.7 billion, forecasted to expand to EUR 2 billion by 2028.

Bulgaria

The IT industry in Bulgaria has achieved an impressive 18% average annual growth since 2019, generating over EUR 4 billion revenue in 2023. Bulgaria’s IT sector is one of the fastest growing and most dynamic sectors in the country, contributing 4.5% of the GDP in 2023. And with each passing year, the country’s outsourcing sector is gaining more influence in its economy. Bulgaria’s substantial tech talent pool and technological capabilities such as skilled resources, and costs’ optimization, drive digital transformation initiatives in the region. Furthermore, the country is one of the leaders in CEE when it comes to the women representation in the industry, with over 29% present in the ICT roles – above the EU average of 19%. The Bulgarian IT sector has also shown resilience by adapting to remote working and digitalization, as part of a government-backed plan to increase IT spending by 4.2% annually over the next 5 years.

Slovakia

As a key player in the Central and Eastern European region, Slovakia is a prime destination for businesses seeking to optimize costs, enhance their technological capabilities, and drive digital transformation. In 2022, the country attracted EUR 2.7 billion in foreign direct investment inflows. The country’s efforts to adapt to digital demands in areas like telecommunications and internet services didn’t go unnoticed as well - Slovakia's IT sector achieved 20% growth in 2020, reaching EUR 8.9 billion. With 4.5% of its workforce in IT (above the EU average) by 2022, Slovakia is slowly building a skilled tech talent pool to support its emerging IT industry. The country is positioning itself to be more competitive in the digital economy going forward by innovating the developed technologies and investing in machine learning.

In conclusion, the breakneck growth in Poland and Czechia underscores their dominance as Central Europe's IT leaders, while statistics from Bulgaria and Slovakia highlight the rapid development of emerging tech talent and digitization across the wider region. This signals ample opportunities for investment in Central and Eastern European IT.

IT Outsourcing and nearshoring in CEE

In European countries, 23% of companies prefer to relocate outsourcing to Poland, with Bulgaria also emerging as a popular nearshore destination, surpassing the first country in terms of IT skills and ranking 18th globally. At the same time, Czechia is demonstrating global leadership in IT innovation, and Slovakia is growing in the number of IT professionals, making them the perfect places to invest in and search for new talents.

Around 87% of IT organizations integrate external workers into their workforce, amounting to 2.2 million ICT professionals in the CEE. The IT outsourcing market in Europe is expected to grow at a compound annual growth rate (CAGR 2024-2028) of 10.5% to reach EUR 219 billion by 2028. And to find the right experts for each emerging project, businesses require professional support. IT consulting and technology remain the most popular outsourced services and account for 32% of the market in 2022.

It’s worth mentioning that some companies prefer the nearshoring model when outsourcing to Eastern Europe, leveraging proximity advantages while benefiting from significant cost savings compared to Western Europe. Nearshoring offers better collaboration and project management than distant, offshore options. According to Deloitte, 50% of companies use outsourcing for accessing new expertise and adapting to business model changes, while 45% explore new outsourcing models and 30% address cybersecurity threats through outsourcing.

At NATEK we are skilled in both offshoring and nearshoring, always accommodating our Customers' needs and requirements. We recognize the positive influence of being present in various CEE locations and obtaining a proximity to our business Partners, but we also don’t view remote work model as an obstacle in efficient communication or delivery of high-quality solutions. We choose to invest in Poland, Czechia, Bulgaria and Slovakia because of their continuous transformation, growth, unique resources when it comes to economy and education, and an outstanding number of qualified specialists from numerous IT fields. Even though we are located in 4 Central European countries, our cutting-edge approach to business and IT innovations influences the IT industry around the world.

Get the complete NATEK CEE IT Market Report

If you want to gain a comprehensive insight into the current state of the IT Market in the CEE region, you have to download our newest report on the matter. We delve into the details of today’s IT job market, such as remote work and rules of employment, evolution of the educational systems, equality improvements and many unique business advantages of each NATEK CEE locations. Download the Report by clicking below and explore the prosperous opportunities in Central Eastern Europe with NATEK!